38+ How much can you borrow for a mortgage

A way to receive reverse mortgage proceeds in which the borrower gets access to a line of credit as well as equal monthly payments for as long as he or she lives in. 20- vs 30-Year Mortgage.

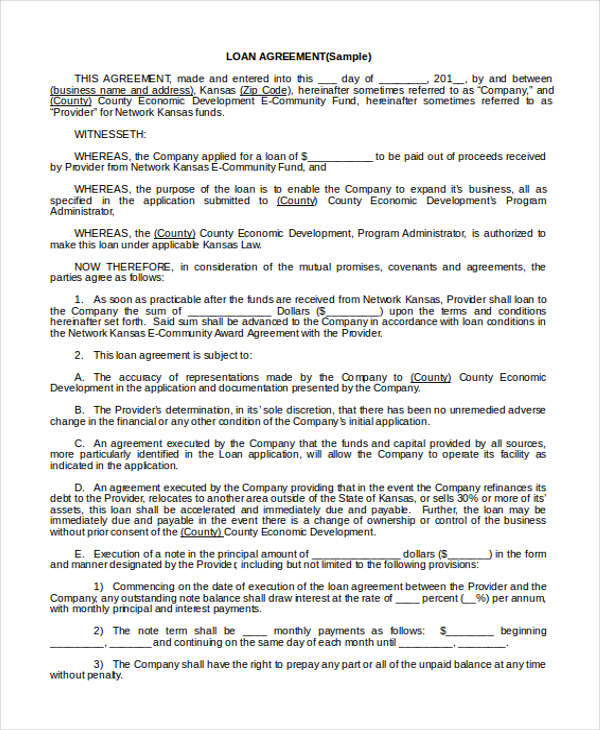

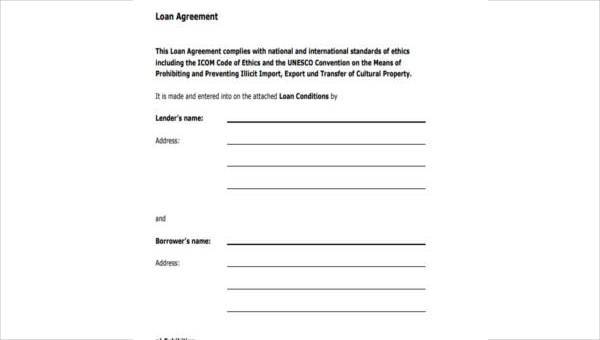

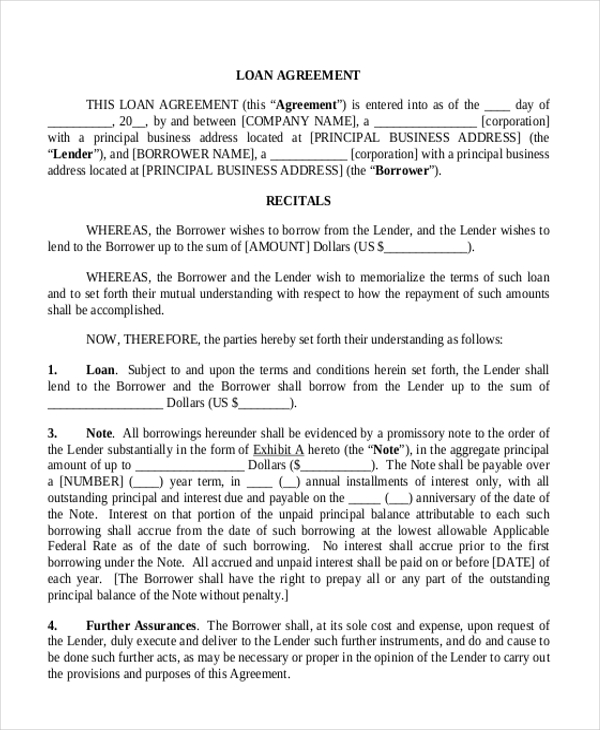

Free 13 Sample Loan Agreement Forms In Pdf Ms Word Excel

Pay off higher interest rate credit cards pay for college tuition.

. Borrow from her 401k at an interest rate of 4. Borrow from the bank at a real interest rate of. Capital and interest or interest only.

Find out how much you could borrow view our mortgage rates compare monthly repayment amounts and more. Many loans have a maximum LVR of 95 which means you cant borrow any more than 95 of the value of your home. First one is based on your assumptions on how much you think you can pay while the 2nd what if scenario is based on the monthly payment you can afford by taking account of the desired debt to income ratio.

The mortgage should be fully paid off by the end of the full mortgage term. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on. Is an Unusual Option Right for You.

With a capital and interest option you pay off the loan as well as the interest on it. If youre ready to buy a home you might wonder how to budget for your target home cost. Heres a breakdown of what you might face monthly in interest and over the life of a 200000 mortgage.

Where to get a 300000 mortgage. Contact New American Funding today to see how much you can save. If youre ready to buy a home you might wonder how to budget for your target home cost.

Cash out debt consolidation options available. Borrow from 8 to 30 years. 4 min read Sep 08 2022 Should you refinance student loans now that pandemic relief is ending.

Stepping onto the property ladder is exciting but can also be overwhelming. The more you borrow the higher your mortgage payment and the more interest youll pay over time. For a 200000 loan a 1 difference means you will pay an additional 35935 over 30 years.

Mortgage calculators and tools. Monthly payments on a 150000 mortgage. There are two different ways you can repay your mortgage.

Though this can be done by reaching out to each mortgage company directly you can also use an online marketplace like Credible. To get the best mortgage loan know how much you can afford and shop like the bargain hunter you are. Her cost of double-taxation on the interest is 80 10000 loan x 4 interest x 20 tax rate.

How much can I borrow. We could help you find the right mortgage deal and help you secure the keys to your first home. It can get expensive so its best to prepare more funds.

At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 71612 a month. FHA loans generally require lower down payments as low as 35 of the home value while other loan types can require up to 20 of the home value as a minimum down payment. How lenders decide how much you can afford to borrow.

Heres a breakdown of what you might face monthly in interest and over the life of a 150000 mortgage. This calculator adds in discount points loan origination fees and closing costs along with any recurring PMI fees into the loans original APR to figure out the effective cost of your loan with all these. Our chattel mortgage repayment calculator can help you estimate your monthly repayments total interest as well as amount payable.

This calculator shows how much you pay each month each year throughout the duration of the loan for each 1000 of mortgage financing. Home Loan Interest Rates. If you borrow 400000 you will pay an additional 71870 in interest over 30 years.

Borrowers can get up to 20000 forgiven but leftover balances could be refinanced. How long would you like your mortgage for. The type of mortgage you choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings.

How much mortgage can I afford. Refinancing a mortgage can be costly however these costs can be recouped over time if youre refinancing to a loan with a lower interest rate. Table 2 shows the total interest paid over 30 years.

Interest rates will have an impact on your mortgage term and how much you will repay each month so its a good idea to get familiar with them. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 95483 a month. Monthly payments on a 200000 mortgage.

To get a 300000 home loan youll want to get quotes from at least a few different lenders. Fixed 395 0. With an interest only mortgage you are not actually paying off any of the loan.

Conforming limits may be lower or higher depending on the location of the house. This affordability tool helps you figure out how much you can actually borrow by analyzing 2 scenarios. The loan amount refers to the total amount of money youre.

Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term. This is how much interest you pay if you keep the mortgage for 30 years and dont make any additional payments. Learn how much you can save with the early payoff mortgage calculator.

Maximum additional loan term is 25 years if any element of your mortgage is on interest only. Over 170000 positive reviews with an A rating with BBB. Please select 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years 36 years 37.

This is the prescribed cap on loan amounts you can borrow for conforming loans. Buying your first home. If you want to refinance this means.

Keeping Room in Your Budget for Other Costs Elapsed Time 0145 A larger home could also mean more money spent on furnishings. It pays to find a home and mortgage deal you can afford. The fixed and variable rates shown below are applicable from 24 th February 2022.

Modified Tenure Payment Plan. You can pay off your mortgage earlier by increasing the monthly payment or seeing the monthly mortgage payment when a borrower has a plan to pay off a.

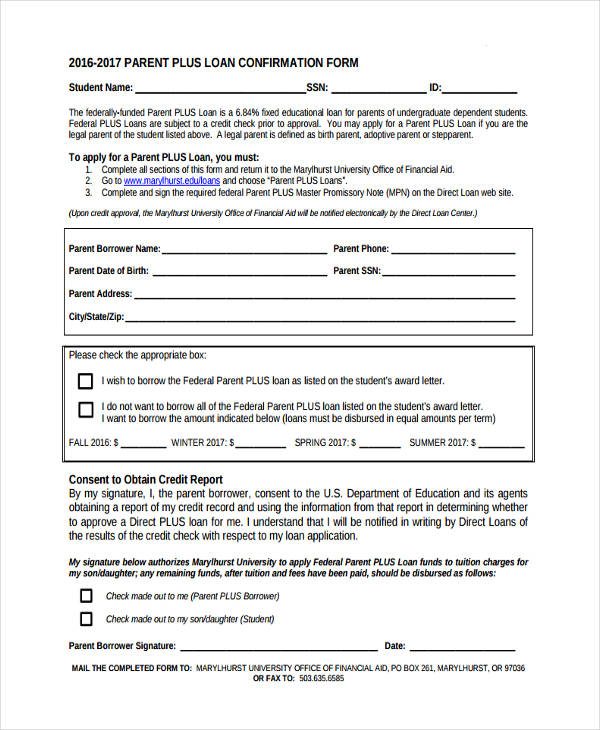

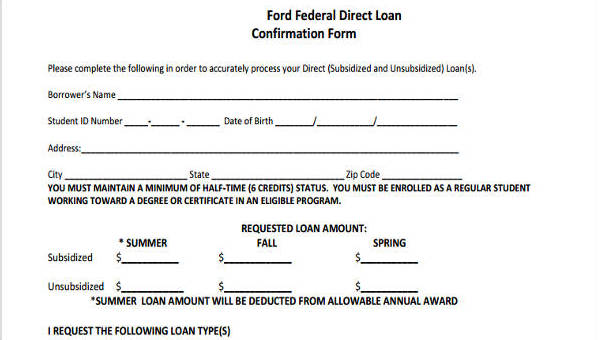

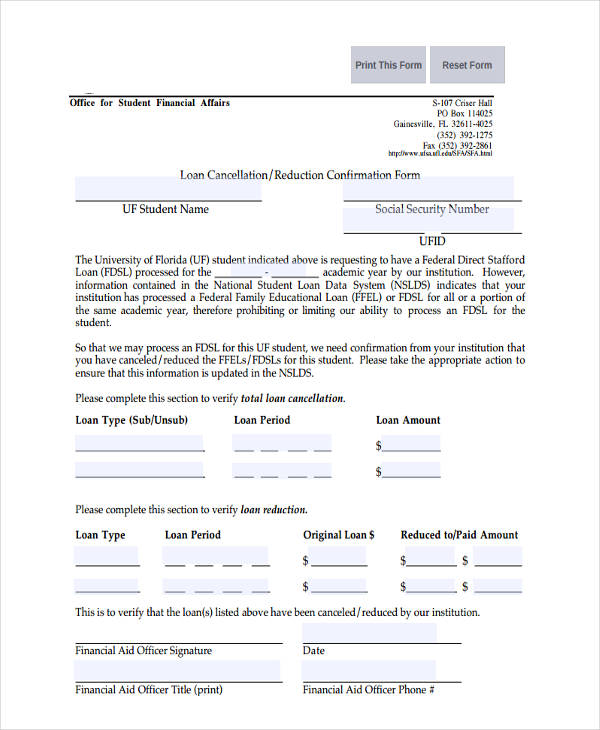

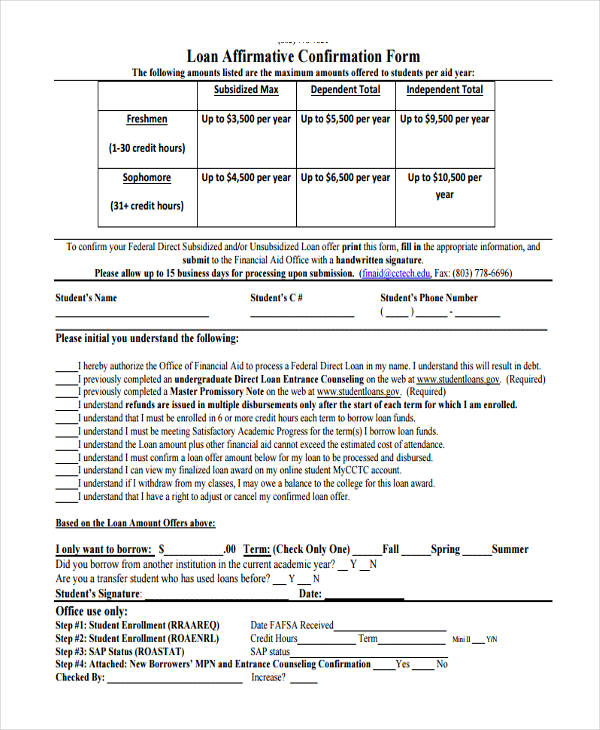

Free 8 Loan Confirmation Forms In Pdf

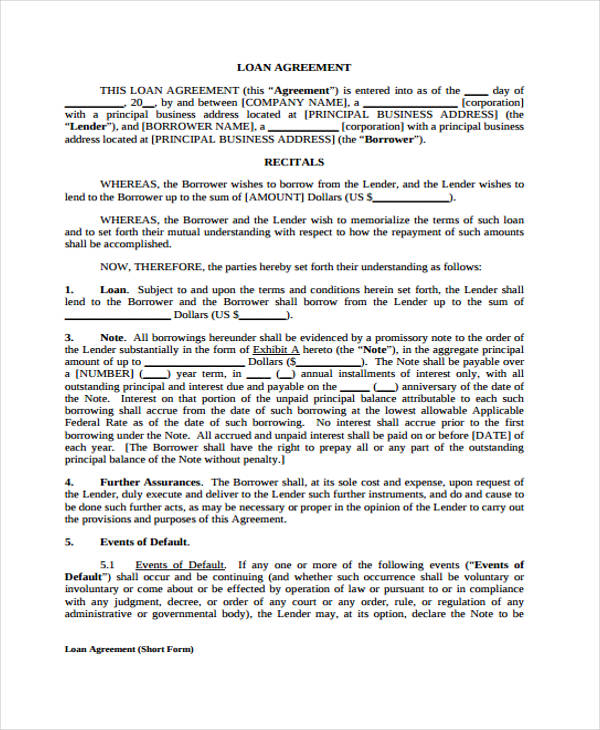

Free 34 Loan Agreement Forms In Pdf Ms Word

Free 8 Loan Confirmation Forms In Pdf

Free 10 Simple Loan Agreement Samples In Pdf

Free 56 Loan Agreement Forms In Pdf Ms Word

Unit Circle Chart Template Business Template Templates Chart

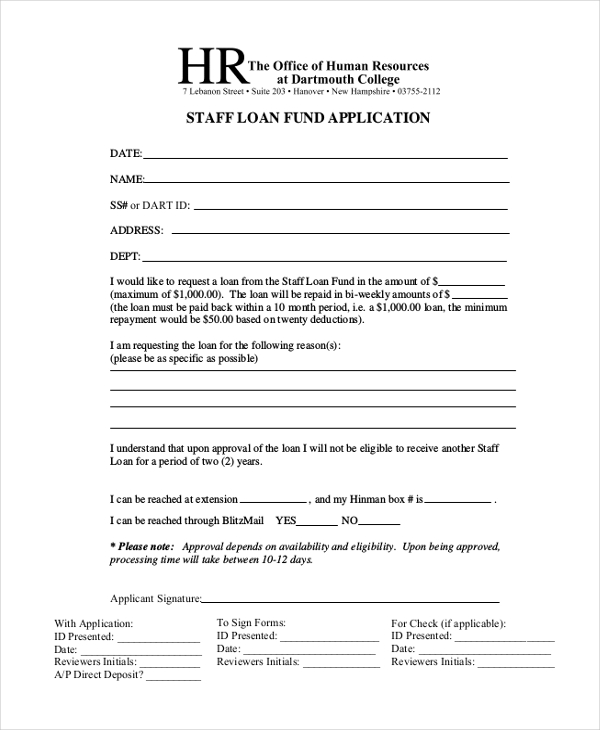

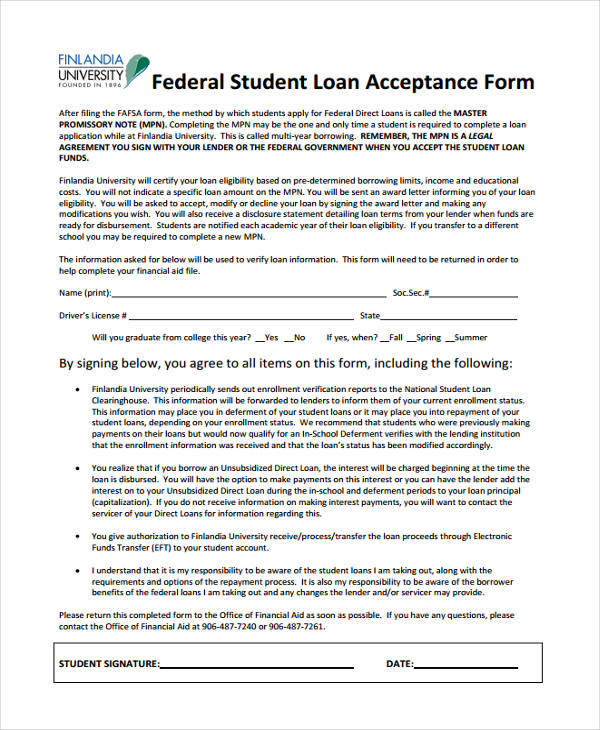

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Borrow Money Contract Template Beautiful Sample Lending Contract Sample Contract Template For Contract Template Agreement Contract

Free 8 Loan Confirmation Forms In Pdf

Free 9 Sample Personal Loan Agreement Forms In Pdf Ms Word

Free 8 Loan Confirmation Forms In Pdf

Free 8 Loan Confirmation Forms In Pdf

Free 14 Money Promissory Note Samples In Pdf

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 13 Sample Loan Agreement Forms In Pdf Ms Word Excel

Free 9 Loan Spreadsheet Samples And Templates In Excel